Finance

How you can Master the 4 spheres of Business – lets talk finance

How understanding your financials will make or break your business.

Who wins? Cash Flow...or Profit?

But are these the right questions? Here’s my view.

The Cash Gap

So often we have clients come to us and say “my business is making great sales, and a decent profit, but there’s never any money in the bank!”. Well we are here to tell you bad cash flow has nothing to do with sales … but everything to do with how you spend and collect your money.

Imagine running your business, bringing in a great deal of money and then finding out that there’s not enough to cover your bills. It literally happens every day, in fact, it would amaze you how often companies go under, right after their highest period in sales.

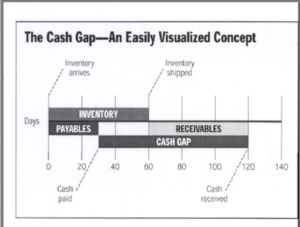

For just one reason … they have literally no idea how to manage their cashflow. The gap between when you pay for a product and when you receive money in the bank for that same product is called The Cash Gap, and it’s a vital piece of information to know.

Easily more than 80% of the business people I meet have no idea about The Cash Gap, and even less of an idea about how to work a budget and keep to it.

Let's look at this in more detail.

Say you buy a box of widgets, which then sit on the shelf for 90 days waiting to be purchased. Your box of widgets sells at 90 days, and then 45 days later you get paid for it. The cash gap here is 90 days shelf time and 45 days until you’re paid … so 135 days (or 4 and a half months) that you have to fund.

Now imagine you had to fund 135 days in a company that grew at 10% and you had 10% margins, well you would almost never get to do anything but re-invest the profits back into the company. Now triple the growth rate to 30% with the same margins, and you will KILL the cashflow unless you can reduce the GAP.

It’s basically where you think you’re making a profit when you’re really not. You see cashflow is about timing, NOT profitability.

It can cost you more than you think...

Another thing to take into account with The Cash Gap is that it’s not just the dollars you don’t have in the bank for that 135 days, but the interest you may be paying on that money, and the cost of starving your business of working capital during that time. We have a calculator that shows you just what the cost of an out of control Cash Gap could be to your business.

So how do we deal with The Cash Gap?

It’s not all bad news! Most businesses will have a cash gap and the important thing is to know what your cash gap is and take steps to alleviate it.

At Action Centre we have a list of 13 strategies to shorten the Cash Gap in your business, here is a sneak peak of what can help:

- Require partial or full deposit on contract to be paid up front - whilst some people believe "this can't be done in my industry", it actually can, but it does require a change of mindset and some changes to procedures. Most business owners are comfortable paying a deposit for quality goods or services.

- Finish projects so that they can be billed/invoiced - there are often a bunch of jobs that are unfinished or dragging on, and all that money adds up.

- Bill/invoice immediately on completion of job - there is nothing more important in your business than keeping invoicing up to date to help cash flow! Whatever you do don't let this drag behind.

If you can work towards minimising The Cash Gap in your business then you’re on the way to alleviating your cash flow problems and maximising both your profits and your investment in your business.

For more information or a chat in person contact Brett Burden at Action Centre.

You’ll find having an Action Centre business coach is just like having a marketing manager, sales team leader, trainer, recruitment specialist and consultant - wrapped in one - all for one nominal investment. We are the business partner you need without sharing your profits - with over 60 years of collective coaching experience to keep you on track and accountable for your own success.

Maximum Utilisation

In earlier discussions we talked in some detail about Break Even of a business (BE). Taking a big picture approach to the business and understanding how that business can operate while covering the cost of operation. We take this thought further in this paper by examining how to apply BE to the individual parts of a business to extract value and profitability.

The middle and the top of ‘things’

To begin this exercise, consider the initial outlay cost, the total outputs possible, and compare those figures with what can be charged to a customer per unit. The easiest way to illustrate this is by looking at the tangible “things” within a business like billable machines - i.e. printing press, industrial sewing machines, excavators, concrete mixers, delivery trucks, industrial ovens etc - they will all have a rating or maximum load that they can output. Let’s find out the BE and the maximum capacity of one of these machines then discuss what those figures means to the business.

Machine A has a cost $15,000 to purchase. We already know the maximum capacity from the manufacturers information - the total mechanical capacity is 100 units per week. The machine will be in use for 48 weeks in a year (with 2 week holiday shutdown and 2 week maintenance/service periods taken out).

Therefore, the breakeven cost per unit for Machine A at total capacity is $3.125 ($15,000 divided by 48 weeks divided by 100 units).

However….

Client sales figures tells us that the business uses this machine to produce a total of 80 units per week. And because we now have a lower output figure, the breakeven cost is higher at $3.91 ($15,000 divided by 48 weeks divided by 80 units). The business now has the confidence to know that minimum charge for a customers has to be above this break even price.

If the market can bear a price of $4.20 per unit and the orders can reach the maximum load (100 units) - the business stands to make an initial profit of $5,160 in the first year of the machine’s purchase and then a tidy sum of $20,160 year-on-year minus minimal maintenance/servicing costs thereafter. Not bad at all.

There are other strategies in increasing a machine’s capacity where there is seasonal fluctuations in demand that can include: increasing promotion on low-peak times, producing end-of-line products or product extensions, or simply choosing to do business with stable consistent customers(1) to level out the year and gain maximum capacity. The break even price per unit however will by and large remain the same and decisions on which strategy to act on can be made with much more certainty.

When the shoe doesn’t fit

Working with tangible objects within a business is, as we mentioned above, straightforward. Looking at people’s maximum capacity is a different kettle of fish as there is no label or guarantee of how much each person can take on. When it comes to this “different shoe” of human resources we will have to use a different measurement. Human Resources are measured in terms of total hours estimated to reach an end period of time (deadline), and the compare those estimated hours against the actual hours performed to reach the deadline. Below is an example of how to put it into practice:

Project Manager A is working 70 hours a week to reach a 4 week deadline and the estimated hours were only 45 hours a week (180 hours). The maximum capacity for the project is a total number of hours at 280 hours. The review of the completed project found that more administrational activities were required to be performed. The cost of the Project Manager was $150 per hour bringing the total cost to the business at $42,000 for this project.

Here is where it gets interesting.

Project Manager B was able to perform the same project in 50 hours per week for 4 weeks, however, this time, Project Manager B was able to utilise other resources within the business to complete the project. The cost of a Project Manager remained at $150 per hour bringing the total cost at $30,000 and the administrational assistant cost $25 per hour for the remaining 80 hours (total $2,000). The total cost to the business on this project was $32,000. That’s a $10,000 cost saving to the business for the same output.

Maximum capacity for a working week of a person can be tied into WH&S (please refer to a previous discussion we had on Workplace Health and Safety) and being constantly aware of a person’s level of fatigue and the ability to perform with a clear mind, in safety. There is a “saturation risk” with human resources, where a person has too much to do (perceived or real), with not enough time, tools or resources to get the job done(2). When the point of saturation takes hold, the person is unable to function normally and has a constant feeling of being overwhelmed, bringing their levels of output down (and potentially increasing errors). Not all people behave as machines do (some of us might like to think we do). Aside from the obvious overspend in using a senior staff member on certain tasks, the toll it will take on the long term viability of keeping that staff member can cost the business in the long run (through retraining and rehiring).

Finding efficiencies in systems, management techniques, redistribution of existing staff, employing temporary staff all are part of the human capital utilisation. Understanding this, and the total hours as the maximum utilisation point, the cost per hour will rest on how each project is managed.

100 and 1 ways

There are many ways to look at maximum utilisation. In the video for this topic the restaurant was the example. In this paper we gave further examples of this thinking and looked at both machinery (things) and people (human resources) and how to use break even and maximum utilisation to work out cost savings and profit margin increases. There are literally over one-hundred-and-one ways to cut the mustard when comes to applying this practice across a business and it is a subject that requires more understanding. When approaching this topic, the team at One Week At A Time believe there are only three ingredients needed to start the road to financial freedom: seeking and following sound advice, applying those strategies to your business, and building your personal confidence in the processes.

Resources

If you would like to discuss your maximum utilisation and break even points please contact Brett Burden, Senior Business Coach on 1300 971 763.

References

(1) Porter, Michael E. (1985). Competitive Advantage. Free Press. (p102)

(2) Murphy J. D., Boucousis C., (2016) On Time On Target: How teams and companies can cut through complexity and get things done...the fighter pilot way. Allen & Unwin. NSW Australia. (p124)

Overdraft is not a dirty word

Why do 80% of businesses fail in the first 5 years? Is it a lack of drive? Not enough hours being put into the business? Well, according to Forbes there are five reasons why businesses fail. The first three involve marketing. The fourth speaks to leadership skills and the final, fifth reason, is because a profitable financial system and business model hasn’t been developed(1). What does any of this have to do with the subject of overdrafts? An overdraft has it’s place in financial systems and models of operating and has worked for many businesses and continue to do so. In this paper we will discuss why businesses use them, what situations they are used in, and the benefits of having one in a business.

Big. Small. It’s all the same.

It doesn’t matter what size a business is before they consider an overdraft fund. At One Week At A Time we have advised many clients to investigate them because it’s key benefit is very simple: if the business hasn’t the cash available to buy goods, services, or pay essential bills, an overdraft set up to fund those purchases until the cash starts flowing again(2).

Banks are unlikely to lend funds to a business with little or no cash flow at the time of the application. Overdrafts are negotiated with the bank directly (i.e. terms, amounts, interest rates, repayments etc), based on the performance of the business and its cash flow seasonality.

Large businesses have a record of the fluctuations and patterns in their business and commonly use overdrafts as part of their financial management system. Smaller businesses may not have as large an operation, but the game still remains the same, which is why overdrafts are widely used there too. Both sized businesses are doing the exactly the same thing when they use an overdraft - they are covering their bases for the upturns and the downturns of their cash flow.

Short-term working capital. That’s it.

What is an overdraft in 3 words? Short Term Capital. In longer words - it’s a stop-gap for specific times in a business’ life and when the funds are accessed by the business, the lender requires regular repayments.

When times are good. And not so good.

The most common time when an overdraft is used is when the business is expanding at a rate of knots. Contrary to belief, overdrafts are used when times are good in a business. More projects and customers are flying in the door and the business needs to quickly buy more equipment, materials or employ more staff faster than the current inflows of cash.

For example when a major contract is signed and it may represents thousands or even hundreds of thousands dollars, the current operating capital may not be enough to cover the cost to meet the contract’s needs. Overdrafts are used to get the project up and running until the first installment of the project’s major invoice is paid (and subsequently the overdraft is paid).

Overdraft funds are also be used in times when the business is slowing down and it’s in a tight position. When invoices are yet to be paid and a slower turn in customers may have happened for the month and there are basics that need to be covered. The critical piece of information when using overdrafts in the downturns is that the business needs to have a high level of certainty that the orders, customers or projects will pick up again. That way the repayments from the overdraft won’t be a problem.

An exercise in reduction.

Keeping a business in the black means reducing all the factors that may slow the business down from continuing doing what it’s doing. Learning fund management tools and finding how to manage cash flow and business operations reduces risk in a business. Robert T. Kiyosaki summed it up best in his book Cashflow Quadrant when he said, “Having financial vision lowers your risk. Being financially blind increases risk... to be successful….you must think in numbers…..understanding financial numbers and systems is crucial”(3). That’s why so many business leaders don’t believe overdrafts are a dirty work - they believe that overdrafts are a tool that’s always ready for them to use, as part of their business’ overall financial armoury.

References

(1) https://www.forbes.com/sites/ericwagner/2013/09/12/five-reasons-8-out-of-10-businesses-fail/#759bc96e6978

(2) http://dnbsmallbusiness.com.au/Essentials/Managing_an_overdraft/indexdl_5617.aspx

(3) Kiyosaki, R. T. (1998). Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom TechPress Inc. Arizona. USA. pp 132-133

Don’t Eat Your Seed Corn

Protecting your flanks

At One Week At A Time how to manage income is a topic many Business Leaders raise. A popular way to explain how to manage inflows of cash is through using the old American saying “don’t eat your seed corn”. Sounds like something someone would say in the 1852 story, Uncle Tom’s Cabin (written by Harriet Beecher Stowe), but it’s a powerful saying that - for want of a better expression - yields results.

Don’t eat your seed corn is a farmer’s saying and it means “that every seed that comes through your hands has the potential to either be eaten or planted for next year’s harvest. You need to make sure that your farm always has enough seed corn to replant the fields on your land so you can enjoy another harvest, next year. If you eat [all of] your seed corn, you won’t have anything to put in the ground and you lose the farm”.(1) The concept behind this story is that by storing away some of the cash that is produced from a business, that a future investment can be made from those savings.

Common Sense Set Up

Before we explore a simple set up of funds, it’s important to note that once a Business Leader decides to engage in a financial change, that they seek out expert legal advice. One Week At A Time are not tax accountants, lawyers or wealth managers (and if you do need those people we can certainly point you in the right direction). What we discuss in our series is the principals behind setting up a business and other areas such as common sense account management (rather than the ins and outs of financial advice). For Business Leaders who are looking to divide their funds the common sense way and to follow what we have found work for our clients, here are three accounts to consider setting up (as a bare minimum):

- Trading Account.

This is the main account which receives/pays for all the day-to-day activities of the business. - Compliance Accounts (two separate accounts)

One would hold the GST and the other to hold Pay-As-You-Go. It’s a good idea to also research if there are other legislative mandatory funds such as long service or annual leave which the business must hold and decide how those funds will be held. - Profit Account.

And herein lies the seed corn. An agreed allocation of profits which are gathered from the business can be placed in this account. For example a percentage or proportion of each sale is placed aside in this account. The magic of cumulative interest will start working for the funds placed in this account.

The above would be where a business could start in managing their accounts. Your business may want to set up an additional account for a “rainy day” to hold 3 months worth of monthly overheads, just in case there is a quiet patch that has extended out longer than the business expected.

Tipping in and staying out

The Profit Account is designed to allow the Business Leader a platform to have a future. Perhaps, rewind that thought back for a minute, and think about what a business does for the Business Owner and Business Leader. It’s not often that people share this fact about what businesses actually do:

When a person owns a business, the business itself is not necessarily going to make that person wealthy. If they sell the business for a large amount, then yes, that can be true, however more is the case that wealth comes from the investments made using the cash brought in from the business. How that investment dollar has managed the yields from those investment decisions will determine the level of true wealth.

As amazing as all of this sounds, creating true wealth requires just one very difficult behaviour to remain constant. That is, tipping in regular deposits into the Profit Account, and more critically - staying out of that account (refraining from making any withdrawals for non-wealth building investments).

A glimpse of Greener Pastures

Setting goals to create a long-term personal future is the next step in not eating your seed corn, harvesting for seasons to come and finding areas in which to grow that investment capital.

Managing Break Even

The Break Even (BE) number is not just another percentage and doesn’t fall into the category of “88% of statistics are made up on the spot”. It’s an actual calculation that is used in business to understand how it is performing. It allows the Business Leader to adjust their business plan and either keep going in their current direction or maybe try a different tact and explore new avenues.

The Break Even answers the question of how many sales does a business need to sell in order to cover the total number of fixed costs and variable costs over a given period of time.

Fixed costs1 can be anything from insurances, property taxes, rent, salaries, utilities to amortising/depreciating tangible assets such as patents or equipment.

Variable costs2 are those items that can fluctuate in cost such as raw materials, production supplies (e.g. machinery inputs that are consumed based on usage like welding wire or even ink cartridges), billable hours of staff wages, commissions, credit card fees, and freight. As these costs are unknowns until the end of a period of time that has passed we can use the Gross Profit Margin (GPM) instead of guessing the variable cost.

Gross Profit Margin is the proportion of profit made after a product or service has been sold. This takes into account the variable costs for manufacturing the item and it can be averaged out to give a more than fair accurate forecast. The GPM can be been used in lieu of the variable cost when calculating Break Even points.

Why Break Even is important to know

Break Even (BE) can be used in different areas of a business, from financial forecasting, pricing strategy, budgeting and setting targets.

Sales is a great focal area to use BE. For example the sales team may be provided with an incentive or bonus for hitting the BE plus 10% over. This way the team have a realistic target they can achieve.

It is important to use the BE when determining sales targets. It’s used when a business is looking to introduce a new product and it needs to determine at what price and how many units it needs to sell in order to produce a profit. The break even gives a mark in the sand that indicates, from that point onward, the product will become profitable. Finding out how many sales are required before a business starts seeing profit means it can make better business decisions.

Apart from setting sales incentives the BE can also show the period of time that a product needs to be in the market (excluding the elasticity of demand1, timing and other market forces).

Additionally, after the initial investment is paid off for a product (when BE is reached) then the business can turn its the attention on the price point. Is the demand steady enough to sustain the same price point? Can the market bear a price increase? Has demand petered off and is it time to bundle the product with another product?

In the earlier discussions regarding Star Products, it was evident that a business with a Star Product has a natural propensity toward its delivery and the added bonus of a level of demand being present. Therefore determining the BE for a Star Product will allow the business to know when the profits will roll in, and enable it to make a sound business forecast for enjoying an ongoing gross profits off that Star Product.

A cornerstone for planning and forecasting is often found with the determination of the Break Even points in a business.

Calculating Break Even

We can now revisit the following - Break Even (BE) is the number of sales that are needed to cover all fixed costs (C) and variable costs (v) over a given period of time. In this section we will estimate our BE over a 6 month period using the following equation:

BE = Fixed Costs (C)

(Gross Profit Margin % ÷ 100)

As discussed above, the actual variable costs aren’t known until the end of the month, therefore in this version of the equation we will use the Gross Profit Margin (%) in place of the variable costs.

Finding the Fixed Costs and Gross Profit Margins is easily located on a business’ Profit and Loss Statement. Each figure should be represented as both a number and as a percentage (ensure the statement has both representations).

Take the total of the last 6 months from the Profit and Loss Statement for the Fixed Costs (number version) and Gross Profit Margin (percentage version). Divide each figure by 6 to provide an average monthly total.

Working example 1

Let’s find out how many sales need to be made to break even when the business has a GPM of 10% and $100,000 worth of fixed costs.

BE = 100,000

(GPM 10% ÷ 100) 0.1

BE = 1,000,000 (1 million)

To cover the fixed business costs of $100,000 when the price point provides a Gross Profit Margin of 10% per sale, the business will need to sell 1 million units of product. That means that at the million sales mark the profit is ZERO.

Remember that the business still needs to manufacture the product. Therefore, the sales are 1 million dollars, the fixed costs are $100,000 and the remaining $900,000 is what it directly costs to manufacture the product itself. The break even is still zero at this point. The first sale after the millionth sale, will be when the business will start to see profits.

Example 2

To understand how Gross Profit Margins work let’s explore the following.

If a product is sold at $1,000 per unit with a 10% Gross Profit Margin, how much profit (P) is made on each product?

P = $1,000 price per unit x (GPM 10% ÷ 100) 0.1

P = $100 profit per unit

This shows that for every unit sold $100 is made on each sale on top of the base costs (which can vary) for manufacturing that product.

Using Break Even with GPM

If a product is sold at a price point of $1,000 per unit and has a 10% Gross Profit Margin, how many products need to be sold to break even?

BE = 1,000

(GPM 10% ÷ 100) 0.1

BE = 10,000

As daunting as it may seem to go back to the drawing board and re-visit a break even figure, working it out is actually good business practice. A solid understanding of where a business is heading with accurate assessment of inputs and outputs using Break Even points, will enable the Business Leader to be confident that the business has long term sustainability.

Online References

1 http://www.accountingtools.com/questions-and-answers/what-are-examples-of-fixed-costs.html

2 http://www.accountingtools.com/questions-and-answers/what-are-examples-of-variable-costs.html

3 http://www.economicsonline.co.uk/Competitive_markets/Price_elasticity_of_demand.html