Operations

Mastering the 4 spheres of business - Operations & Systems

10 Reasons why you need to start Planning now!

Eight… Teen…. Days.

So how’s your planning going for your business in 2018? Have you got your Marketing and Sales plans in place ready to start the new year with a bang? Have you got your financial plans in place to make sure you have a good cash flow and then a profit?

2018 Consumer Trends affecting Small Business - No. 4 Technology

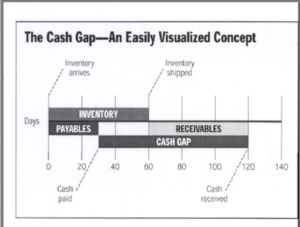

The Cash Gap

So often we have clients come to us and say “my business is making great sales, and a decent profit, but there’s never any money in the bank!”. Well we are here to tell you bad cash flow has nothing to do with sales … but everything to do with how you spend and collect your money.

Imagine running your business, bringing in a great deal of money and then finding out that there’s not enough to cover your bills. It literally happens every day, in fact, it would amaze you how often companies go under, right after their highest period in sales.

For just one reason … they have literally no idea how to manage their cashflow. The gap between when you pay for a product and when you receive money in the bank for that same product is called The Cash Gap, and it’s a vital piece of information to know.

Easily more than 80% of the business people I meet have no idea about The Cash Gap, and even less of an idea about how to work a budget and keep to it.

Let's look at this in more detail.

Say you buy a box of widgets, which then sit on the shelf for 90 days waiting to be purchased. Your box of widgets sells at 90 days, and then 45 days later you get paid for it. The cash gap here is 90 days shelf time and 45 days until you’re paid … so 135 days (or 4 and a half months) that you have to fund.

Now imagine you had to fund 135 days in a company that grew at 10% and you had 10% margins, well you would almost never get to do anything but re-invest the profits back into the company. Now triple the growth rate to 30% with the same margins, and you will KILL the cashflow unless you can reduce the GAP.

It’s basically where you think you’re making a profit when you’re really not. You see cashflow is about timing, NOT profitability.

It can cost you more than you think...

Another thing to take into account with The Cash Gap is that it’s not just the dollars you don’t have in the bank for that 135 days, but the interest you may be paying on that money, and the cost of starving your business of working capital during that time. We have a calculator that shows you just what the cost of an out of control Cash Gap could be to your business.

So how do we deal with The Cash Gap?

It’s not all bad news! Most businesses will have a cash gap and the important thing is to know what your cash gap is and take steps to alleviate it.

At Action Centre we have a list of 13 strategies to shorten the Cash Gap in your business, here is a sneak peak of what can help:

- Require partial or full deposit on contract to be paid up front - whilst some people believe "this can't be done in my industry", it actually can, but it does require a change of mindset and some changes to procedures. Most business owners are comfortable paying a deposit for quality goods or services.

- Finish projects so that they can be billed/invoiced - there are often a bunch of jobs that are unfinished or dragging on, and all that money adds up.

- Bill/invoice immediately on completion of job - there is nothing more important in your business than keeping invoicing up to date to help cash flow! Whatever you do don't let this drag behind.

If you can work towards minimising The Cash Gap in your business then you’re on the way to alleviating your cash flow problems and maximising both your profits and your investment in your business.

For more information or a chat in person contact Brett Burden at Action Centre.

You’ll find having an Action Centre business coach is just like having a marketing manager, sales team leader, trainer, recruitment specialist and consultant - wrapped in one - all for one nominal investment. We are the business partner you need without sharing your profits - with over 60 years of collective coaching experience to keep you on track and accountable for your own success.

Easy Business Systems

A system is a device we can use to solve a problem. That’s all it is. You have jumped the first hurdle in implementing a system. The hurdle that suggests systems are complex and difficult to understand. There are two more hurdles to address when it comes to systems, that is, that it takes an enormous amount of time to put a system in place and that a system is costly.

In a small to medium sized business there are many of problems to solve but without the safety of an allocated budget to employ a team of people to work on resolving a specific problem in a business. How does the smaller business owner approach problems such as rehiring staff, speeding up invoicing to customers, finding funds for sales offers, building a local presence, and handling debts on loans and credit cards? In many cases the business owner are often personally performing those tasks directly. Attending interviews, working late at night to produce invoices, juggling overdrafts and post messages from their phone on the way to the next meeting. It becomes virtually untenable to continue working as a sole proprietor rather than a leader who oversees the management of a team.

Once it’s identified that there is a major time issue with managing daily tasks there is a cross road or an impasse that is reached. Do I continue doing it all myself or do I hire others and teach them through a central system to do it for me? Let’s challenge the assumption that to be a good business leader you need to know each moving part of a business intimately in order to be able to see the business clearly and manage it as a whole. On the whole most people who are, for example, excellent at sales and people-orientated, may not be as highly skilled and involved in areas such as managing stock levels, scheduling just-in-time customer orders, and quality control of products. Just like we say “there’s an app for that”, there are also systems for that too. Every system must have an objective to reach, a business problem to solve. If the system works then continue with it, if it doesn’t, find a different system. More on different types of systems later.

User friendly systems

When we think of “user friendly” we may break out in a small sweat and worry about how a computer program may or may not work. The main point to remember is that systems are developed by people. If we want them to be friendly we just have to change them to suit us. So, what is a user friendly system?

Systems that suit you

There are systems that you can buy “off the shelf” that are computer based billing systems, payroll managers such as Quickbooks. These can be used straight away in a business with a level of external training.

And there are experts that have already been trained, that you can hire to manage a computer system to control specialist areas such as operations, stock and maintenance. Both of these options are viable to a point, and does require an amount of research and capital expenditure.

An example of simple business systems could be when a business leader taught a staff member how, for example to manage an issue. This could have been invoicing. Once the owner has imparted “their way” the team member writes down notes, take screen shots, list out steps and compile a “how to guide”. The next step is to take a different team member unrelated to the task, and ask them to follow the guide and test out whether they understand the instructions and if the guide is easy to follow.

The above example describes the beginnings of what is the global accreditation system called ISO accreditation, by the International Organisation for Standardization1. The basic premise is that if there is an accessible “how to guide”, mapping out in simple terms, the exact task, and this guide is used by more than two people then it is a “system”. The system then need only be “sense checked” (meaning people questioned it, understood it and it is relevant) and continually improved by the team in the business. This system making tool is low cost, high impact and meets the objective of creating more time to work on the greater issues facing the business. Taking the idea of systems back to the invoicing example the business benefits enormously because after the “tester” understands the guide, they can perform that task well, making two more people fully trained and ready to take on that activity, creating time for the business owner to spend to think of ideas, develop more efficiencies and generally work on their business.

References:

1 http://www.iso.org/iso/home/standards/management-standards/iso_9000.htm

Useful Links

Business Process mapping:

https://sourcemaking.com/uml/modeling-business-systems/business-processes-and-business-systems

Simple business systems

http://yfsmagazine.com/2014/02/03/how-to-create-simple-business-systems/