So often we have clients come to us and say “my business is making great sales, and a decent profit, but there’s never any money in the bank!”. Well we are here to tell you bad cash flow has nothing to do with sales … but everything to do with how you spend and collect your money.

Imagine running your business, bringing in a great deal of money and then finding out that there’s not enough to cover your bills. It literally happens every day, in fact, it would amaze you how often companies go under, right after their highest period in sales.

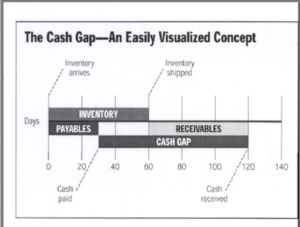

For just one reason … they have literally no idea how to manage their cashflow. The gap between when you pay for a product and when you receive money in the bank for that same product is called The Cash Gap, and it’s a vital piece of information to know.

Easily more than 80% of the business people I meet have no idea about The Cash Gap, and even less of an idea about how to work a budget and keep to it.

Let's look at this in more detail.

Say you buy a box of widgets, which then sit on the shelf for 90 days waiting to be purchased. Your box of widgets sells at 90 days, and then 45 days later you get paid for it. The cash gap here is 90 days shelf time and 45 days until you’re paid … so 135 days (or 4 and a half months) that you have to fund.

Now imagine you had to fund 135 days in a company that grew at 10% and you had 10% margins, well you would almost never get to do anything but re-invest the profits back into the company. Now triple the growth rate to 30% with the same margins, and you will KILL the cashflow unless you can reduce the GAP.

It’s basically where you think you’re making a profit when you’re really not. You see cashflow is about timing, NOT profitability.

It can cost you more than you think...

Another thing to take into account with The Cash Gap is that it’s not just the dollars you don’t have in the bank for that 135 days, but the interest you may be paying on that money, and the cost of starving your business of working capital during that time. We have a calculator that shows you just what the cost of an out of control Cash Gap could be to your business.

So how do we deal with The Cash Gap?

It’s not all bad news! Most businesses will have a cash gap and the important thing is to know what your cash gap is and take steps to alleviate it.

At Action Centre we have a list of 13 strategies to shorten the Cash Gap in your business, here is a sneak peak of what can help:

- Require partial or full deposit on contract to be paid up front - whilst some people believe "this can't be done in my industry", it actually can, but it does require a change of mindset and some changes to procedures. Most business owners are comfortable paying a deposit for quality goods or services.

- Finish projects so that they can be billed/invoiced - there are often a bunch of jobs that are unfinished or dragging on, and all that money adds up.

- Bill/invoice immediately on completion of job - there is nothing more important in your business than keeping invoicing up to date to help cash flow! Whatever you do don't let this drag behind.

If you can work towards minimising The Cash Gap in your business then you’re on the way to alleviating your cash flow problems and maximising both your profits and your investment in your business.

For more information or a chat in person contact Brett Burden at Action Centre.

You’ll find having an Action Centre business coach is just like having a marketing manager, sales team leader, trainer, recruitment specialist and consultant - wrapped in one - all for one nominal investment. We are the business partner you need without sharing your profits - with over 60 years of collective coaching experience to keep you on track and accountable for your own success.

Comments are closed.